Capital. Talent. Impact.

Capital. Talent. Impact.

Capital. Talent. Impact.

EQUATOR IS DEDICATED TO IMPROVING LIVES IN LASTING WAYS

We promote economic, social and sustainable development through private sector investments in financial services

Equity capital for growth stage financial services companies

with a track record of success

with a track record of success

Adding developmental impact to financial returns

Integrating talent to achieve greater scale and efficiency

Equity capital for growth stage financial services companies with a track record of success

PARTNER WITH US

Our current fund partners with African financial institutions to significantly enhance value and deliver superior returns

EQUATOR HELPS

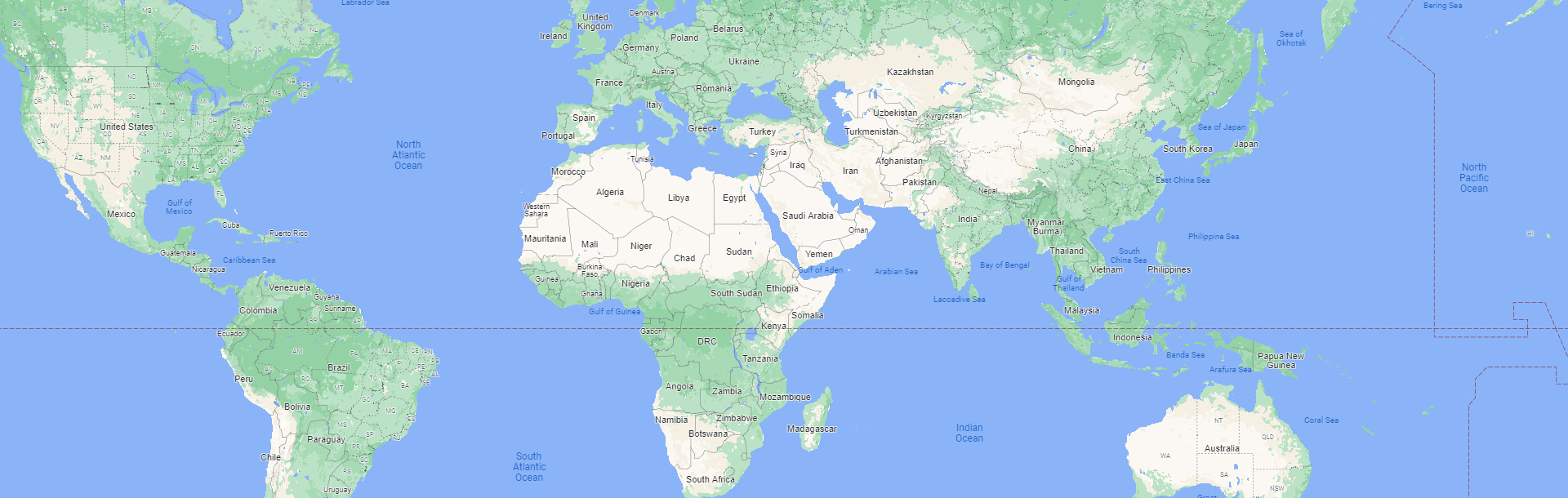

CREATE OPPORTUNITIES IN EMERGING ECONOMIES

By combining capital with capacity building,

we helped build 28 MFIs and small business

banks in 29 countries across 3 continents

we helped build 28 MFIs and small business

banks in 29 countries across 3 continents

Loans to Deserving Borrowers

0

Generated for

Microentrepreneurs and

Small Business Owners

Microentrepreneurs and

Small Business Owners

0

New Employees at Our

Investee Companies

Investee Companies

0

Active Savers Mobilized

0

Savings Deposited

0

REALIZED INVESTMENT

ShoreCap International

Hyderabad, India – Bhartiya Samruddhi Finance Limited (BSFL)

REALIZED INVESTMENT

ShoreCap International

Minsk, Belarus – Belarusian Bank for Small Businesses

REALIZED INVESTMENT

ShoreCap International

Dhaka, Bangladesh – BRAC Bank

REALIZED INVESTMENT

ShoreCap International

Kabul, Afghanistan – BRAC Bank Afghanistan

REALIZED INVESTMENT

ShoreCap International

Kigali, Rwanda – Compagnie Générale de Banque SA (Cogebanque)

REALIZED INVESTMENT

ShoreCap International

Kampala, Uganda – Commercial Microfinance Ltd

REALIZED INVESTMENT

ShoreCap International

Khujand, Tajikistan – Eskhata Bank OJSC

REALIZED INVESTMENT

ShoreCap International

Yerevan, Armenia – Ineco Bank

REALIZED INVESTMENT

ShoreCap International

Lahore, Pakistan – Kashf Microfinance Bank

REALIZED INVESTMENT

ShoreCap International

Nairobi, Kenya – K-Rep Bank

REALIZED INVESTMENT

ShoreCap International

Lagos, Nigeria – MIC Microfinance Bank

REALIZED INVESTMENT

ShoreCap International

Manila, Philippines – Planters Development Bank

REALIZED INVESTMENT

ShoreCap International

Banjul, The Gambia – Reliance Microfinance Ltd.

REALIZED INVESTMENT

ShoreCap International

Phnom Penh, Cambodia – Sathapana Limited

REALIZED INVESTMENT

ShoreCap International

Ulanbatar, Mongolia – Xac Bank LLC

REALIZED INVESTMENT

ShoreCap II Limited

Benin, Burkina Faso, Cote d’Ivoire, Mali, Niger, Senegal and Togo – Bank Atlantique

FBC HOLDINGS LIMITED

ShoreCap II Limited, through its Fund Manager, Equator, has acquired an equity interest in FBC Holdings Limited (FBCH), a diversified financial services group with interests in commercial banking, stock brokering, mortgage and reinsurance services based in Harare, Zimbabwe. FBCH is the investment holding company of the FBC Group. FBCH is listed on the Zimbabwe Stock Exchange and represents diverse financial institutions that span a Commercial Bank, Microfinance Subsidiary, Building Society, Reinsurance Company and a Stockbroking unit. All of SC II’s investment proceeds were directed to Microplan, the microfinance subsidiary, for the purposes of increasing their service to micro, small and medium enterprises. Microplan is now able to offer more and larger loans, provide business education to its borrowers, and offer the appropriate insurance products for SMEs to grow and protect their businesses. http://www.fbc.co.zw/

KHUSHHALI BANK LIMITED

Founded in the year 2000, Khushhali Bank Limited is headquartered in Islamabad, Pakistan. The Bank’s mission as a commercial based microfinance institution is to strengthen the economic base of low-Income populace across Pakistan by improving their accessibility to financial services. Equator’s investment on behalf of ShoreCap II in 2012 was undertaken to restructure the ownership of the bank and to provide capital for future growth. Co-investors alongside ShoreCap II include Triple Jump, Incofin and ResponsAbility, in addition to United Bank Limited, Pakistan’s third largest commercial bank. http://www.khushhalibank.com.pk/

MADISON FINANCE COMPANY LIMITED (‘MFINANCE’)

MFinance is a licensed NBFI that serves Micro and SME customers. MFinance was established in 2010 with the merger of Capital Solutions Limited (a microfinance company) and Madison Premier Finance Limited (SME & Leasing finance company), both of which were majority owned by MFSL, Zambia’s premier insurance and financial services group. In 2012, ShoreCap II invested equity and quasi-equity investment in MFinance, a Bank of Zambia registered Non-Bank Finance Institution. Our primary interest was to provide growth capital to strengthen MFinance’s capital base as it expands its enterprise lending activities (micro and small business) in underserved areas in Zambia and also provide the company with the like-minded investment partner it sought. http://www.mfinance.co.zm/REALIZED INVESTMENT

ShoreCap II Limited

New Delhi, India – Satin Creditcare Network Limited

REALIZED INVESTMENT

ShoreCap II Limited

Baku, Azerbaijan – TuranBank

UB FINANCE COMPANY

UB Finance, formerly known as The Finance & Guarantee Company Limited (FGCL), is based in Sri Lanka. ShoreCap II’s equity investment was completed in 2012 and is being used to expand UB Finance’s lending to small businesses, primarily through leasing and hire purchase activities. FGCL was formed in 1961 as a regulated finance company. FGCL has a long history and excellent reputation for delivering quality products and services at competitive prices. http://www.ubfinance.lk/REALIZED INVESTMENT

ShoreCap II Limited

Abuja, Nigeria – Fortis Microfinance Bank Plc.

REALIZED INVESTMENT

ShoreCap II Limited

Nairobi, Kenya – Jamii Bora Bank Ltd

REALIZED INVESTMENT

ShoreCap II Limited

Bangalore, India – Chaitanya Rural Intermediation Development Services Pvt. Ltd. (CRIDS)

MFS Africa

MFS Africa is a leading Pan-African fintech company, operating the largest digital payments hub on the continent. The MFS Hub is connected to over 170 million mobile wallets in Sub-Saharan Africa, offering unparalleled reach for merchants, banks, mobile operators and money transfer companies. Its close partnership with players across the ecosystem brings simple and secure mobile financial services to un- and under-banked customers. ShoreCap III’s investment helped MFS Africa scale and deliver innovative mobile-based financial services to its network, allowing it to further connect consumers and small businesses and facilitate cross-border remittance and trade transactions within Africa. http://mfsafrica.com

BRAC Uganda Bank Ltd. (BRAC Uganda)

BRAC Uganda Bank Ltd. (formerly BRAC Uganda Microfinance Limited) was founded in 2006 as part of the global NGO, BRAC. BRAC Uganda became the country’s largest microfinance institution while also maintaining meaningful involvement in the health, nutrition and education sectors. It recently transformed into a Tier 2 Credit Institution in order to expand its product range and service offerings to help drive more impactful financial inclusion at an even greater scale. Funds from ShoreCap III’s 2019 investment supported the institution with its transformation process. https://www.bracinternational.nl/en/where-we-work/uganda/